EquityMultiple Review

What is Real Estate Crowdfunding

The rise of crowdfunding in the real estate space has its root in the JOBS Act of 2012, which lowered the threshold & requirements and allowed active marketing to average investors. These ads are on Facebook and other media platforms and in general an investor has to pass a accreditation test. Some platforms advertise no investor requirements and thresholds as low as $500 for funding an account.

This can be beneficial to all and in general can be a good thing, however while the intentions are good, there are always unintended consequences.

Investopedia provides a definition and background and The Best Real Estate Crowdfunding Sites of 2020. The list has most likely not changed much since 2019, however there are many horror stories of investors loses on platforms that no longer exist today.

EquityMultiple (EQ) is one of many crowdfunding platforms that we reviewed and shortlisted in 2019. Their marketing and website provided data of an above average historical track record of past returns, when compared with traditional stocks. We reviewed many deals on the platform and after a few emails & calls, we chose to invest in two deals on their platform.

The sign up process was easy and intuitive. The document signing process was completely digital and painless. We chose to setup the investment under a trust, which EQ was able to accommodate. The investor dashboard provides a reasonable overview of investments and monthly payments, which are made 15-45 days after EQ has received funds. Their fees are disclosed and we had a reasonable level of trust and confidence that the expected/projected returns would be predictable.

Source - https://www.equitymultiple.com/track-record - (11/13/2020)

These are averages and totals provided as a snapshot only

EQ Investment 1

The investment term was 22 months, with a projected return of ~10%. For the first five months, dividends were received on time and as expected. In month 6 there were some unexpected charges and fees. We expected the platform to absorb the fees, however they were passed onto the investors. In subsequent months, the return percentage has been reducing from the original projection. The investment term will be due in four months and the investment amount is not significant enough to argue. This is also in the midst of Covid19, lockdowns and challenges for real estate developers.

EQ Investment 2

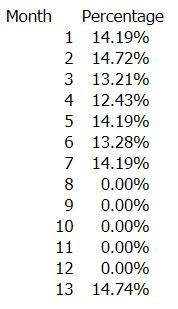

The investment term was 4 months, with a projected return of ~14%. Payments were received on time till May 2020. Covid19 had a significant impact and no payments were received, till Nov 2020. The final payment and closeout of the deal made up for the missing/delayed payments.

Month 13 is calculated over 218 days for the catchup paymentShould you invest with EquityMultiple ?

Unfortunately, our results and experience are in the middle of lockdowns and challenges. Real estate developers have had a challenging time delivering on the promises and projections and could not have predicted the events of 2020.

As an investor, there has been a lack of information and transparency, however 2020 has been a challenging year or all and we can't entirely rest blame on EQ or the platform.

We would consider further investments in the platform.